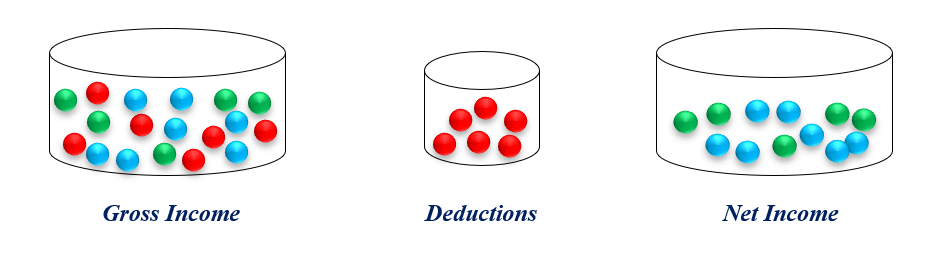

Suppose your mother has a bowl of candy balls in different colors. She then asked you to remove all red-coloured candy balls and told you that you could have the rest left in the bowl. This situation illustrates what happens with income, specifically net income and gross income.

The bowl of candy balls with different colors represents the gross income. The red candy balls removed from the bowl are the deductions like expenses and government taxes. All the candy balls in the bowl represent your net income or take-home income.

Since you already know the number of candy balls you can have or eat, you could divide them into sections on how you will consume them. This scenario is now related to saving and budgeting, which tells you how to limit your spending based on your net income.

What is Net Income?

Definition

The total amount of money received by an individual or business after all deductions have been made is known as net income. Net income is additionally known as take-home pay.

How to Calculate Net Income?

The easiest way to calculate net income is to subtract all total deductions from gross income or all earnings.

Here is the formula to help you calculate net income:

Net Income Formula

NI = GI – TD

where;

NI = Net Income

GI = Gross Income

TD = Total Deductions

Net Income vs Gross Income: Differences and Calculations

Net income and Gross income are concepts that are frequently confused since gross income is used to calculate net income.

For instance, knowing the difference between gross and net income is essential whether you manage your own business or receive a monthly salary as an employee to evaluate your personal spending or assess the company’s stability.

Gross income

Your total earnings during a specific time period are your gross income. Adults typically receive this from their paychecks. For children, the gross income typically consists of an allowance, gifts, or money earned via chores.

Let us say, for instance, you earn $12 per hour and you work 40 hours a week. Your paycheck schedule is every two weeks. To find your gross income every two weeks, you must multiply $ 12 by 80 hours since you have worked for 80 hours in two weeks.

Here is the math to calculate your gross income for two weeks:

Gross Income = $ 12 x 80

Gross Income = $ 960

Hence, your gross income for two weeks is $ 960.

Net Income

After paying for necessary deductions, your net income is what is left over from your gross income. Taxes and retirement account contributions are typical fees for adults. These kinds of net income-related problems don’t substantially affect children until they begin formal employment.

There could be further deductions that reduce your net income. Deductions are a specified sum or a portion of the base pay that any authority holds as a form of required dues. Premiums for dental, vision, short-term disability and health insurance are some of the most frequent deductions. If you take part in your employer’s retirement plan, there are also retirement plan contributions.

The amount of money you can take home to spend, save, and share is, therefore, your net income.

For example, suppose your gross monthly income is $ 4000, and you have a total deduction of $ 900; your monthly net income will then be $ 3100.

Net Income = Gross Income – Total Deductions

Net Income = $ 4000 – $ 900

Net Income = $ 3100

The table below shows comparisons between net income and gross income.

| Gross Income | Net Income |

| The amount that a person or business makes before subtracting expenses is known as their gross income. | The amount that a person or business makes after subtracting expenses is known as their gross income. |

| A person’s gross income is their total earnings before taxes. | A person’s net income is their total earnings after taxes. |

| Typically, gross income is higher than net income. | Net income is typically lower than gross income. |

What is the Use of Net Income?

It is important to understand net income since it indicates how much can be spent on both living expenses and discretionary expenses. These are typically referred to as wants, whereas living needs are typically called needs. Any expenditures that are not strictly necessary are referred to as discretionary expenses. As a result, discretionary expenses are usually more related to lifestyle and choice.

Here are some examples of net income for companies and individuals.

A company’s net income

For four straight months, a company posted earnings of $8 billion. Additionally, it generated $3 billion in other income in addition to $2 billion in interest. The company spent $5 billion on operational expenditures and administrative costs, including $2.5 billion on labor costs. The company’s net income is $ 5.5 billion. The way of calculating net income is as follows:

Gross Income = $ 8 billion + $ 3 billion + $ 2 billion

Gross Income = $ 13 billion

Total Deductions = $ 5 billion + $ 2.5 billion

Total Deductions = $ 7.5 billion

Net Income = Gross Income – Total Deductions

Net Income = $ 13 billion – $ 7.5 billion

Net Income = $ 5.5 billion

Net income is important since it demonstrates a company’s accomplishments. Understanding net income is essential for any company because it gives them the option to decide where to increase investment or generate additional revenue. Additionally, it aids businesses in understanding the finance options.

An individual’s net income

An employee receives her monthly paycheck with a gross income of $ 3700. She pays a total of $ 780 on government taxes and insurance. The way of calculating the employee’s net income is:

Net Income = Gross Income – Total Deductions

Net Income = $ 3700 – $ 780

Net Income = $ 2920

Therefore, the employee’s monthly net income is $ 2920.

How is Net Income Important?

These are just some of the importance of knowing net income:

- People can better arrange their budgets and taxes.

- Owners of businesses may have perspectives that have an impact on the objectives and operations of the company.

- Investors can evaluate a company’s financial position.

- The management can estimate future trends and set goals.

- Businesses can use net income to forecast their operating cash flow and earnings per share.

Net Income Examples

The following are examples of word problems involving net income.

Example 1:

Felix has total earnings of $ 200 from working the entire week. Suppose he has a total deduction of $ 37. How much is his net income?

Solution:

The total earning is his gross income which is $ 200, and the total deductions would be $ 37. To compute his net income, we have,

Net Income = Gross Income – Total Deductions

Net Income = $ 200 – $ 37

Net Income = $ 163

Hence, Felix has a net income of $ 163.

Example 2:

A grocery store earns $ 250 000. In addition, it had an interest income of $ 8000 but paid taxes of $ 4000. For materials and goods, the grocery store spent $ 120 000 and a total of $ 70 000 for other expenses like labor, maintenance, operational and administrative costs. Find the net income of the company.

Solution:

To find the net income of the grocery store, we must first compute the gross income by adding all earnings, $ 250 000 and $ 8000. Then subtract all expenses for materials, goods, labor, maintenance, operational and administrative costs, $ 120 000 and $ 70 000.

Gross Income = $ 250 000 + $ 8000

Gross Income = $ 258 000

Total Deductions = $ 120 000 + $ 70 000

Total Deductions = $ 190 000

Net Income = Gross Income – Total Deductions

Net Income = $ 258 000 – $ 190 000

Net Income = $ 68 000

Therefore, the grocery store’s net income is $ 68 000.

Example 3:

Joshua gets a monthly income of $ 20 000. How much is his net income if he pays $ 500 for taxes, $ 150 for insurance, and $ 300 for other government deductions?

Solution:

To calculate the total deductions we have,

Total Deductions = $ 500 + $ 150 + $ 300

Total Deductions = $ 950

To solve his monthly net income, subtract $ 950 from $ 20 000.

Net Income = $ 20 000 – $ 950

Net Income = $ 19 050

Hence, Joshua’s monthly net income is $ 19 050.

Example 4

Angelo works 30 hours a week with a $ 20 rate per hour. Monthly, he is paying $ 45 for federal tax, $ 34 for Social Security tas and $ 9 for Medical insurance. How much is Angelo’s monthly net income?

Solution:

Since Angelo works 30 hours a week, he works 120 hours monthly. If his hourly rate is $ 15, his monthly gross income is $ 2400.

Mothly Total Work Hours = 30 hours x 4 = 120 hours

Monthly Gross Income = 120 x 20 = $ 2400

Get the sum of all specified deductions, federal tax, social security and insurance.

Total deductions = $45 + $34 + $9

Total Deductions = $ 88

To calculate his net income, subtract the total deductions from his monthly gross income.

Net Income = Gross Income – Total Deductions

Net Income = $ 2400 – $ 88

Net Income = $ 2312

Therefore, Angelo’s monthly net income is $ 2312.

Example 5:

Below is the paycheck received by Yna. Complete the missing information and find his net income.

| Hourly Rate: $ 18 | Deductions: |

| Total Worked Hours: 180 hours | Federal Income Tax: $ 40 |

| Social Security Tax $ 34 | |

| Medical Insurance $ 10 | |

| Others $ 8 | |

| Total Deductions: ? | |

| Gross Income: ? | Net Income: ? |

Solution:

To solve for Yna’s total monthly earnings or gross income, multiply his total worked hours of 180 by his hourly rate of $ 18.

Gross Income = $ 18 x 180

Gross Income = $ 3240

Here is how to solve the total deductions:

Total Deductions = $ 40 + $ 35 + $ 20

Total Deductions = $ 95

To calculate Yna’s net income, subtract the total deductions from her gross income. That is,

Net Income = Gross Income – Total Deductions

Net Income = $ 3240 – $ 95

Net Income = $ 3145

Hence, Yna’s net income is $ 3145.

Example 6:

The gross salary of Eric is $ 48 000, and he paid taxes of $ 1510. Find his net salary.

Solution:

To find Eric’s net salary, subtract the $ 1510 that he paid for taxes from his earnings of $ 48 000. Thus, we have,

Net Income = Gross Income – Total Deductions

Net Income = $ 48 000 – $ 1510

Net Income = $ 46490

Therefore, Eric’s net salary is $ 46490.

Example 7:

Find the gross income of Martha; suppose her net income is $ 52 000 and the total deductions made to pay for taxes is $ 10 500.

Solution:

Since the net income formula is Net Income = Gross Income – Total Deductions, then to find Martha’s gross income add the total deductions to her net income.

Gross Income = Net Income + Total Deductions

Gross Income = $ 52 000 + $ 10 500

Gross Income = $ 62 500

Hence, Martha’s gross income is $ 62 500.

Example 8:

An organization has the income statement as shown below. The gross income and list of expenses are given. Find the net income using the formula.

Simple Income Statement

Gross Income $ 750 000

Expenses

Cost of Goods $ $210 000

Operating $ 48 500

Administrative $ 12 400

Others $ 11 200

Solution:

The first step is to get the total amount of deductions. That is adding the stated amount for the cost of goods $ 210 000, operating expenses $ 48 500, administrative expenses $ 12 400, and other $ 11 200.

Total Deductions = $ 210 000 + $ 48 500 + $ 12 400 + $ 11 200

Total Deductions = $ 282 100.

To calculate the organization’s net income, subtract the computed total deductions of $ 282 100 from the gross income of $ 750 000.

Net Income = Gross Income – Total Deductions

Net Income = $ 750 000 – $ 282 100

Net Income = $ 467 900

Hence, the organization’s net income is $ 467 900.

Example 9:

Cecile’s gross income is $ 52 300, and she paid taxes of $ 2 120. Find her net income.

Solution:

To find Cecile’s net income, subtract the $ 2 120 that she paid for taxes from his earnings of $ 52 300. Thus, we have,

Net Income = Gross Income – Total Deductions

Net Income = $ 52 300 – $ 2120

Net Income = $ 50 180

Therefore, Cecile’s net income is $ 50 180.

Example 10:

David puts in 40 hours weekly at an hourly rate of $18. He pays $ 52 in federal taxes each month, $ 38 in Social Security taxes, and $ 12 for health insurance. What is Angelo’s net monthly income?

Solution:

David works 40 hours weekly, equating to 160 hours per month. His monthly gross income is $ 2880 if his hourly rate is $18.

Mothly Total Work Hours = 40 hours x 4 = 160 hours

Monthly Gross Income = 160 x 18 = $ 2880

Calculate the total of all the given deductions, federal taxes, social security, and insurance.

Total deductions = $ 52 + $ 38 + $ 12

Total Deductions = $ 102

To calculate his net income, subtract the total deductions from his monthly gross income.

Net Income = Gross Income – Total Deductions

Net Income = $ 2880 – $ 102

Net Income = $ 2778

Thus, David’s monthly net income is $ 2778.

Summary

- Definition

The total amount of money received by an individual or business after all deductions and allowances have been made is known as net income. This is additionally known as take-home pay.

Your total earnings during a specific time period are your gross income.

Deductions are a specified sum or a portion of the base pay that any authority holds as a form of required dues. Premiums for dental, vision, short-term disability and health insurance are some of the most frequent deductions.

How to calculate net income?

Net Income Formula: NI = GI – TD

where; NI = Net Income

GI = Gross Income

TD = Total Deductions

How to calculate gross income?

Gross Income Formula: GI = NI + TD

where; GI = Gross Income

NI = Net Income

TD = Total Deductions

Importance of Net Income

These are some of the importance of net income to people and businesses.

- People can better arrange their budgets and taxes.

- Owners of businesses may have perspectives that have an impact on the objectives and operations of the company.

- Investors can evaluate a company’s financial position.

- The management can estimate future trends and set goals.

- Businesses can use net income to forecast their operating cash flow and earnings per share.

Frequently asked Questions (FAQs)

What is meant by net income?

The total amount of money received by an individual or business after all deductions have been made is known as net income. This is additionally known as take-home pay.

How do I calculate net income?

To calculate net income, subtract total deductions from gross income.

What is the formula for getting net income?

NI= GI – TD

or

Net Income = Gross Income – Total Deductions

What is the difference between net income and gross income?

Your total earnings during a specific time period are your gross income, while net income is the total amount of money received after all deductions have been made is known as net income

What are deductions?

Deductions are a specified sum or a portion of the base pay that any authority holds as a form of required dues. Premiums for dental, vision, short-term disability and health insurance are some of the most frequent deductions.

What is the importance of net income in a company or business?

Net income is important since it demonstrates a company’s accomplishments. Understanding net income is essential for any company because it gives them the option to decide where to increase investment or generate additional revenue. Additionally, it aids businesses in understanding the finance options.

What is net income important to people?

Net income is important since it helps people to arrange their budgets and taxes.

Is the gross income of an individual before or after deductions?

The amount that a person or business makes before subtracting expenses is known as their gross income. Hence, gross income is an individual’s earnings after all the deductions.

Is net income before or after deductions?

The total amount of money received by an individual or business after all deductions have been made is known as net income. Hence, net income is the total amount after deductions.

Does net income include tax?

Net income does not include tax. Taxes like federal and social and security are included in the total deductions.

Should budgets be created using gross or net income?

Limiting your spending to what you earn is better, and you should base your budgeting on your net rather than your gross income.

Why is my gross income higher than my net income?

Your gross income is the total earnings before all deductions like taxes and insurance. On the other hand, net income, also known as take-home pay, is your income after all deductions. The gross income is typically higher than the net income since the net income is the difference when total deductions are subtracted from gross income.

How do I calculate gross income from net income?

Add net income and total expenses/deductions to calculate gross income from net income. For example, a worker has take-home pay of $ 4050. He paid a total of taxes and insurance of $ 420. To calculate his gross income, we have,

Gross Income = Net Income + Total Deductions

Gross Income = $ 4050 + $ 420

Gross Income = $ 4470

Recommended Worksheets

Net Income (National Salesperson Day Themed) Math Worksheets

Sales Tax (Halloween Themed) Math Worksheets

Discount (Black Friday Sale Themed) Math Worksheets